DUN & BRADSTREET HIGHLIGHTS FOUR EMERGING RISKS IN OUR GLOBAL TOP 10

The latest Dun & Bradstreet Global Business Impact score highlights in increase in risk for businesses across the world. The nature of risk continues to change, with four new entries among our top ten risks, led by new uncertainties associated with President-elect Trump’s policy agenda.

GLOBAL BUSINESS RISK REACHES RECORD LEVELS

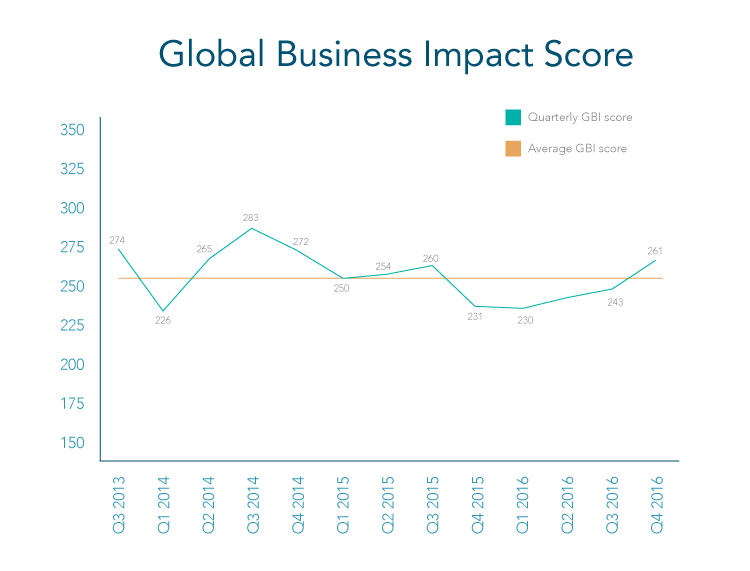

Dun & Bradstreet’s Global Business Impact (GBI) score for Q4 2016 worsened for a third consecutive quarter, to 281 (out of a maximum of 1,000), from 243 in Q3. The Q4 figure is the second highest on record, and is only just below the all-time high of 283 recorded in Q3 2014. The developments in Q4 take the score significantly above the long-term average (254.2) for the first time since Q3 2015. Nevertheless, the average of 247.25 for 2016 is an improvement on the averages seen in 2015 (248.75) and 2014 (261.50). The latest score confirms our view that business conditions are still feeling the after-effects of the global financial crisis, and the risks have been further compounded by political issues. Business conditions are significantly worse than they were before the global financial crisis.

Our top ten risks combine an assessment of: (i) the magnitude of the event’s probable effect on the global business operating environment, on a scale of 1 to 5 (where 1 is the smallest impact and 5 is the largest); and (ii) the likelihood of the event happening.

Our top ten risks combine an assessment of: (i) the magnitude of the event’s probable effect on the global business operating environment, on a scale of 1 to 5 (where 1 is the smallest impact and 5 is the largest); and (ii) the likelihood of the event happening.

FOUR NEW RISKS EMERGE FROM THE TOP 10

The Q4 2016 GRM has four new entries, highlighting that finance, procurement and supply chain teams across all sectors of business face urgent and ever-evolving risks in an increasingly complex and globalised world. The four new-entry risks are:

Global uncertainty among policy-makers, businesses and households over the lack of detail in President-elect Trump’s policies curtails US business activity as well as cross-border trade and investment prospects (GBI 42, out of a maximum 100);

A hard Brexit disrupts supply chains across Europe (GBI of 39);

Capital flight from China weakens the yuan and triggers a wave of currency selling in Asia and other emerging economies (21); and

Military success against Islamic State in Iraq, Libya and Syria triggers a spate of attacks by the group in the Middle East and Europe, disrupting the business environment (20).

Among our pre-existing risks, we have increased the likelihood (from 50% to 70%) of the new US president scrapping the TTIP and TPP trade deals and renegotiating NAFTA, threatening global trade and investment; this has resulted in the GBI increasing from 20 to 28. The remaining five risks saw no change in their GBI scores from Q3 2016.

POLITICAL ISSUES SPAWN THE GREATEST RISKS

Political issues are currently undermining the global business environment. One of the risks associated with these issues is a new entry right at the top of our list, with a GBI score of 42 (out of a maximum 100). This is our concern that global uncertainty among policy-makers, businesses and households over the lack of detail on President-elect Trump’s policies will curtail US business activity – as well as cross-border trade and investment prospects. This impact is liable to be short-term only.

Political issues are currently undermining the global business environment.

In second place is the reaction of politicians to the UK’s vote to leave the EU by apparently pushing for a ‘hard’ Brexit, which will raise barriers between the UK and EU. This is liable to impact on supply chains across Europe. We assign a 65% likelihood to this risk, with a GBI of 39. Furthermore, although it will be at least 27 months until the UK leaves the EU, short-term uncertainty about the post-Brexit relationship between the UK and the EU is affecting the global business environment.

Two other political risks feature in our top ten. In joint fourth place (with a GBI of 28, up from 20 in Q3 2016 because we have increased its likelihood from 50% to 70%) is a second political risk emanating from North America: the potential collapse of the TTIP and TPP trade deals and the renegotiation of NAFTA. This would seriously undermine growth prospects for cross-border trade and investment – and indeed could have knock-on effects on other multi-lateral cross-border trade and investment deals.

In sixth place, with a GBI of 27 (the same as in the previous report), is a pan-regional risk: the potential collapse of a migrant-management deal between the EU and Turkey would lead to a fresh influx of migrants into Western Europe, threatening both social stability in Europe and local supply chains.

CHINESE GROWTH CONCERNS REMAIN AFFECT THE GLOBAL ECONOMY

The importance of the Chinese economy is highlighted by the presence of three China-related risks in the top ten. In third place, with a GBI of 30 (the same as in the previous report), is the threat of possible default contagion in China. Should this happen it would trigger additional problems in the financial sector, necessitating state rescues and emergency capital issues, particularly for mid-tier banks. Among the upstream industries that currently appear to have too much capacity are steel-making, ship-building, solar panels, coal, property and local government (and possibly cement, glass-making, aluminium and commercial real estate in the Yangtze River delta). A systemic collapse in the Chinese financial sector would curtail cross-border trade and investment opportunities.

The Q4 2016 GRM has four new entries, highlighting that finance, procurement and supply chain teams across all sectors of business face urgent and ever-evolving risks in an increasingly complex and globalised world.

The second China-related risk, which is in seventh place overall with a GBI of 26 (down from 28 in the previous report), relates to default contagion from industry, property and local government: in this instance the slowing of China’s real GDP growth to below 5% would seriously affect the growth prospects for many emerging markets.

The third China-centred risk is a new entry in eighth place, having been bubbling under in the previous report. We are concerned that capital flight could force China’s yuan to weaken past the psychologically-important CNY7:USD point, triggering a wave of currency-selling in Asia and other key emerging markets. We have increased the likelihood of this happening from 25% to 35%, raising the GBI from 15 to 21.

Meanwhile, in fourth equal place with a GBI of 28 (no change) is a second pan-regional risk. Rapidly growing cyber-dependence and connectivity could lead to increasingly frequent and more damaging cyber-attacks, with ramifications for doing business.

The final new entry is in joint ninth place with a GBI of 20 (up from 16 previously, as we have increased its likelihood from 40% to 50%). This risk is associated with the military success in combatting Islamic State in Iraq, Syria and Libya. Our concern here is that this will result in the group undertaking high-profile attacks in the Middle East and Europe in order to offset the setbacks. This could disrupt the business environment in both regions.

Also in joint ninth place is our final key risk, which emanates from Latin America. We are concerned that widespread public discontent across the region in response to the collapsing regional economy will lead to a sharp rise in violent anti-government protests that disrupt the rule of law and further impair the already weak business environment.

The third China-centred risk is a new entry in eighth place, having been bubbling under in the previous report. We are concerned that capital flight could force China’s yuan to weaken past the psychologically-important CNY7:USD point, triggering a wave of currency-selling in Asia and other key emerging markets. We have increased the likelihood of this happening from 25% to 35%, raising the GBI from 15 to 21.

THE GLOBAL BUSINESS ENVIRONMENT AFFECTED BY RAPIDLY CHANGING RISKS IN Q4

The Dun & Bradstreet Global Business Impact score for Q4 2016 highlights that risks facing businesses have increased in the quarter, and that they are trending towards their historic highs of 2014. The business environment remains challenging, and business decision-makers need to be aware of the rapidly-changing risk environment.

For more information on the Global Risk Matrix, watch the Dun & Bradstreet 2017 Global Outlook Webinar